Summary of the 2017 Tax Reform

May 16, 2018

Congress has passed the largest piece of tax reform legislation in more than three decades. This article summarizes the most important changes to individual and corporate tax law.1

On December 22, 2017, President Trump signed Public Law 115-97, “An Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018,” which was originally called the “Tax Cuts and Jobs Act” before that title had to be dropped due to procedural objections.

The 2017 Tax Law made the most sweeping changes to individual and corporate tax law in decades and also reduced the estate tax.

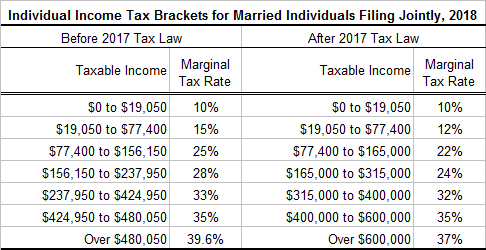

The 2017 tax law altered the individual rates and bracket structures, maintaining seven rates as in prior law but reducing several of them—including cutting the top rate from 39.6% to 37.0%. The full set of these changes for married couples in the first year are as follows:

In addition, the law nearly doubled the standard deduction, eliminated personal exemptions, reduced the individual Alternative Minimum Tax (AMT), and doubled the child tax credit from $1,000 to $2,000. The law also limited some tax benefits, most notably capping the deductibility of State and local taxes at $10,000 and lowering the cap on the mortgage interest deduction for new mortgages from $1,100,000 to $750,000. Finally, effective 2019 the law sets the Shared Responsibility Payment to zero, effectively repealing the individual mandate that was originally established by the Affordable Care Act.

The law established a new 20% deduction for certain pass-through income. The deduction applies broadly to individual filers making less than $157,500 and joint filers making less than $315,000. For individual filers making more than $207,500 and joint filers making more than $415,000 annually the pass-through deduction is limited by a set of guardrails, including that it does not apply to personal services firms and is limited by the amount of wages and potentially capital a firm has. The tax law also doubled the exemption for the estate tax from $5.6 million to $11.2 million in 2018, or from $11.2 million to $22.4 million for married couples.

All of the individual, pass-through and estate provisions sunset after 2025, with the exception of the shift to chained CPI and the de facto repeal of the individual mandate.

On the corporate side, the law cut the statutory corporate tax rate from 35 to 21%. It also allows businesses to fully expense investments in equipment for five years and then phases down that favorable treatment, returning to previous depreciation schedules starting in 2027. The law also includes a number of domestic offsets that pay for a portion of these costs, including repealing the domestic production deduction, limiting the deductibility of interest to 30% of earnings (defined as earnings before interest, tax, and amortization or EBITA before 2021 and earnings before interest or EBIT thereafter), requiring five-year amortization of research and experimentation expenditures starting in 2022, and limiting net operating loss carrybacks and carryforwards.

The law also made major changes to international business taxation including establishing a territorial system and reducing the tax rate on foreign intangibles associated with income derived in the United States. These costs are almost exactly offset within the ten-year budget window with two major new anti-abuse provisions, a minimum tax on Global Intangible Low-taxed Income (GILTI) that is 10.5% through 2025 and 13.125% thereafter and also a Base Erosion and Anti-abuse tax that functions like an alternative minimum tax on inbound investment. In addition, the law mandated a one-time payment on existing overseas earnings and allowed free repatriation of these earnings thereafter.

- Source: “The macroeconomic effects of the 2017 tax reform” by Robert J. Barro and Jason Furman, March 8-9, 2018. ↩